Contacts & Resources

Important Contacts

South Carolina Emergency Management Division

scemd.orgThe Great Southeast Shakeout

shakeout.org/southeastSouth Carolina Geological Survey

dnr.sc.gov/geology/State Seismic Network via the University of South Carolina

seis.sc.edu/projects/SCSN/Lowcountry Hazards Center via College of Charleston

hazards.cofc.edu/index.phpThe Central United States Earthquake Consortium

cusec.orgUnited States Geological Survey

usgs.gov/programs/earthquake-hazards/earthquakesEarthquake Safety Information for People with Disabilities

earthquakecountry.org/accessibility

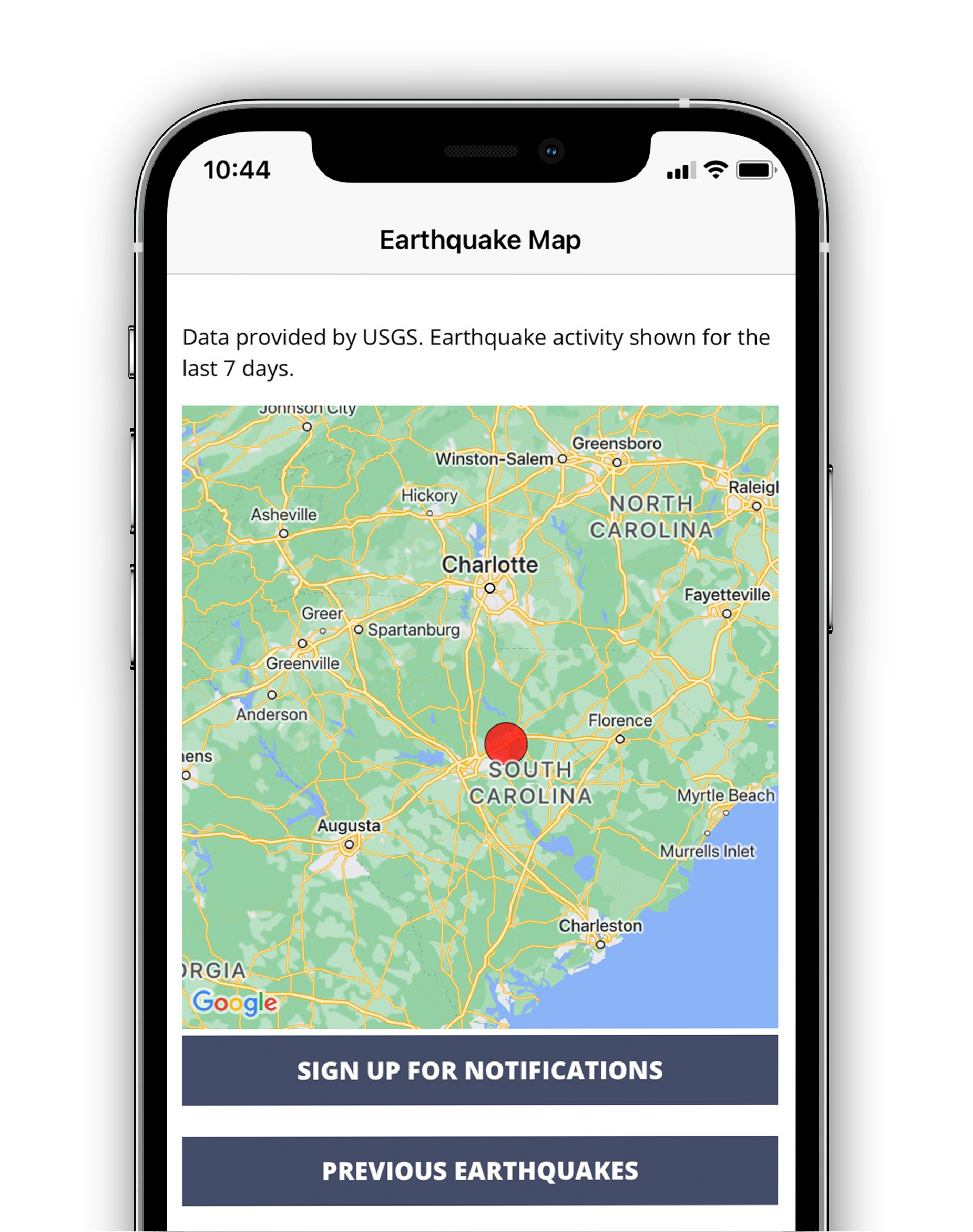

SC Emergency Manager App

Take advantage of the official app of the South Carolina Emergency Management Division (SCEMD).

- Get notified when an earthquake occurs

- Keep track of your disaster supplies

- Earthquake tracker map

- Local emergency manager information

- Emergency strobe light & alert whistle

- Share your location with emergency contacts

- Get traffic & weather updates

- Document property damage

- Know about state office closings & delays

- “Emergency Mode” during major disasters

Insurance

Most people don't buy earthquake insurance because they think it's too expensive and an earthquake will never happen to them. In South Carolina, the entire state is considered to have a moderate to high risk for earthquakes.

Reasons to Consider Earthquake Insurance

- An earthquake of the same magnitude as the 1886 earthquake would cost close to $40 billion in today’s dollars. (Source: Applied Insurance Research)

- Most homeowner and rental insurance policies DO NOT cover damages caused by an earthquake, but coverage can be added to most policies as an "endorsement" for an additional cost.

- Even in earthquake-prone areas, only 25-28% of homeowners have earthquake insurance. (Source: Western Insurance Information Institute)

- Earthquake deductibles are set as percentages, i.e. 5% or 10% of the coverage amount rather than dollar amounts. The earthquake deductibles apply separately from your basic homeowner's (and business) policy deductible.

- Following a damaging earthquake, South Carolinians could face loss of life, injury and property damage. Without earthquake insurance, you will have to pay for all losses to your home and possessions.